Tax Rate Tobacco Australia . 95% ci −1·378 to −0·112) and sustained reductions in. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. Web find the current excise duty rates for tobacco manufactured or imported into australia. Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. About one in 10 australian adults are daily.

from taxfoundation.org

Web find the current excise duty rates for tobacco manufactured or imported into australia. Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. 95% ci −1·378 to −0·112) and sustained reductions in. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. About one in 10 australian adults are daily. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase.

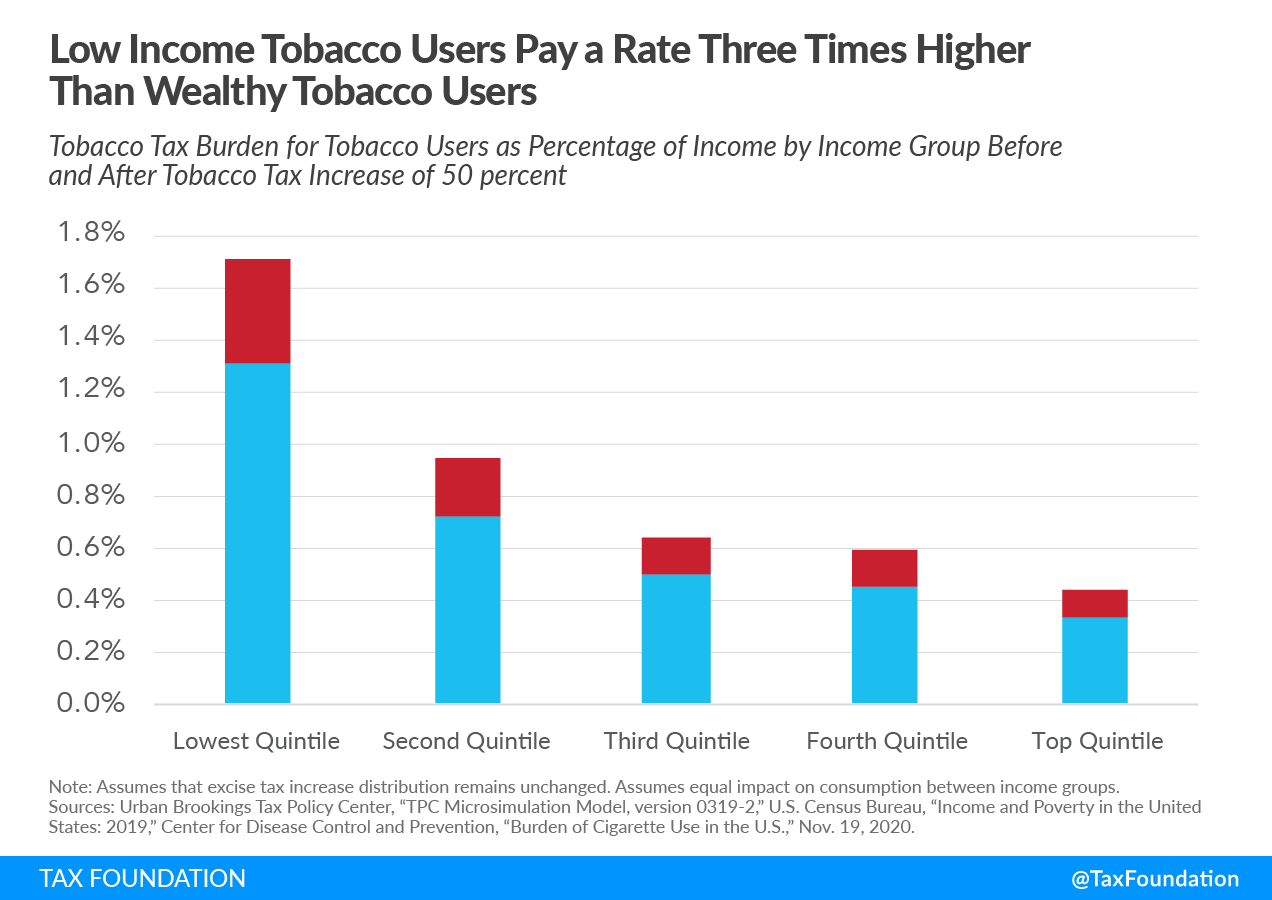

Excise Taxes Excise Tax Trends Tax Foundation

Tax Rate Tobacco Australia About one in 10 australian adults are daily. Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web find the current excise duty rates for tobacco manufactured or imported into australia. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. 95% ci −1·378 to −0·112) and sustained reductions in. About one in 10 australian adults are daily. Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary.

From taxfoundation.org

Excise Taxes Excise Tax Trends Tax Foundation Tax Rate Tobacco Australia Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. 95% ci −1·378 to −0·112) and sustained reductions in. Web smokers across australia will. Tax Rate Tobacco Australia.

From bnttp.net

Can the tobacco tax structure cut back tobacco use and raise government Tax Rate Tobacco Australia Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. About one in. Tax Rate Tobacco Australia.

From www.weforum.org

Which countries have the highest tax on cigarettes? World Economic Forum Tax Rate Tobacco Australia Web the 25% tax increase was associated with immediate (−0·745 percentage points; 95% ci −1·378 to −0·112) and sustained reductions in. About one in 10 australian adults are daily. Web find the current excise duty rates for tobacco manufactured or imported into australia. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to. Tax Rate Tobacco Australia.

From taxfoundation.org

Monday Map Tobacco Tax Revenue as a Percentage of Total State & Local Tax Rate Tobacco Australia Web find the current excise duty rates for tobacco manufactured or imported into australia. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web excise duty rates on tobacco goods increase in march. Tax Rate Tobacco Australia.

From www.tobaccoinaustralia.org.au

1.3 Prevalence of smoking—adults Tobacco in Australia Tax Rate Tobacco Australia Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. 95% ci −1·378 to −0·112) and sustained reductions in. Web find the current excise duty rates for tobacco manufactured or imported into australia. About one in 10 australian adults are daily. Web since 1920, the rate of the. Tax Rate Tobacco Australia.

From www.change.org

Petition · Lowering Australian tobacco taxes and price increases Tax Rate Tobacco Australia 95% ci −1·378 to −0·112) and sustained reductions in. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. About one in 10 australian adults are daily. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act. Tax Rate Tobacco Australia.

From tobacconomics.org

5 Things You Should Know About Tobacco Taxes Tobacconomics Tax Rate Tobacco Australia Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. 95% ci −1·378 to −0·112) and sustained reductions in. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web find the current excise duty rates for tobacco manufactured or imported into australia. Web tobacco excise. Tax Rate Tobacco Australia.

From www.commonwealthfoundation.org

Cigarette Taxes Target the Poor Commonwealth Foundation Tax Rate Tobacco Australia Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. About one in 10 australian adults are daily. Web since 1920, the rate of the duty. Tax Rate Tobacco Australia.

From www.researchgate.net

Comparison of 2015 and 2016 Tobacco Excise Tax Rates Download Table Tax Rate Tobacco Australia About one in 10 australian adults are daily. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web find the current excise duty rates for tobacco manufactured or imported into australia. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. 95% ci. Tax Rate Tobacco Australia.

From tobaccocontrol.bmj.com

Impact of three annual tobacco tax rises on tobacco sales in remote Tax Rate Tobacco Australia Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. About one in 10 australian adults are daily. Web find the current excise. Tax Rate Tobacco Australia.

From tobtax.avior.tax

Tobacco Tax Rates by State — Avior Tobacco Tax Tax Rate Tobacco Australia Web the 25% tax increase was associated with immediate (−0·745 percentage points; 95% ci −1·378 to −0·112) and sustained reductions in. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web find the current excise duty rates for tobacco manufactured or imported into australia. Web. Tax Rate Tobacco Australia.

From www.helgilibrary.com

Which Country Has the Lowest Tax on Cigarettes? Helgi Library Tax Rate Tobacco Australia Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. About one in 10 australian adults are daily. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. Web tobacco excise is among the. Tax Rate Tobacco Australia.

From www.tobaccoinaustralia.org.au

13.5 Impact of price increases on tobacco consumption in Australia Tax Rate Tobacco Australia Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. About one in 10 australian adults are daily. Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web excise duty rates on. Tax Rate Tobacco Australia.

From www.mirror.co.uk

Pack of cigarettes to cost £23 in Australia and 69 of that is tax Tax Rate Tobacco Australia Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. Web the 25% tax increase was associated with immediate (−0·745 percentage points; 95% ci. Tax Rate Tobacco Australia.

From www.taxpolicycenter.org

State Cigarette Tax Rates Tax Policy Center Tax Rate Tobacco Australia Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. 95% ci −1·378 to −0·112) and sustained reductions in. Web find the current. Tax Rate Tobacco Australia.

From www.athra.org.au

ATHRA Today’s tobacco tax rise exploits and punishes addicted smokers Tax Rate Tobacco Australia Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. Web tobacco excise is among the most lucrative individual tax measures collected by the federal government, worth more than $15 billion a year. About one in 10 australian adults are daily. Web find the current excise duty rates. Tax Rate Tobacco Australia.

From www.researchgate.net

Tobacco tax rates in 1998/1999 and 2014 as per cent of retail price Tax Rate Tobacco Australia Web find the current excise duty rates for tobacco manufactured or imported into australia. Web excise duty rates on tobacco goods increase in march and september each year under the law, based on average weekly ordinary. Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web since 1920, the rate of the duty has been set out. Tax Rate Tobacco Australia.

From www.thelancet.com

Smoking prevalence following tobacco tax increases in Australia between Tax Rate Tobacco Australia Web the 25% tax increase was associated with immediate (−0·745 percentage points; Web since 1920, the rate of the duty has been set out in (frequently amended) schedules to the excise tariff act passed in 1921. Web smokers across australia will have to pay as much as $10 more per cigarette packet due to a massive tax increase. About one. Tax Rate Tobacco Australia.